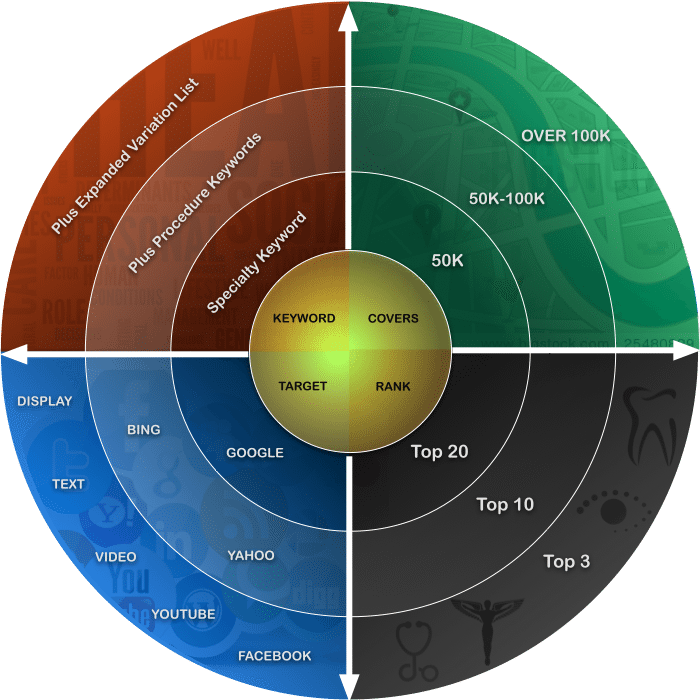

Claim your 50% tax credit when you upgrade your dental website to make it compliant with ADA (Americans with Disabilities Act).

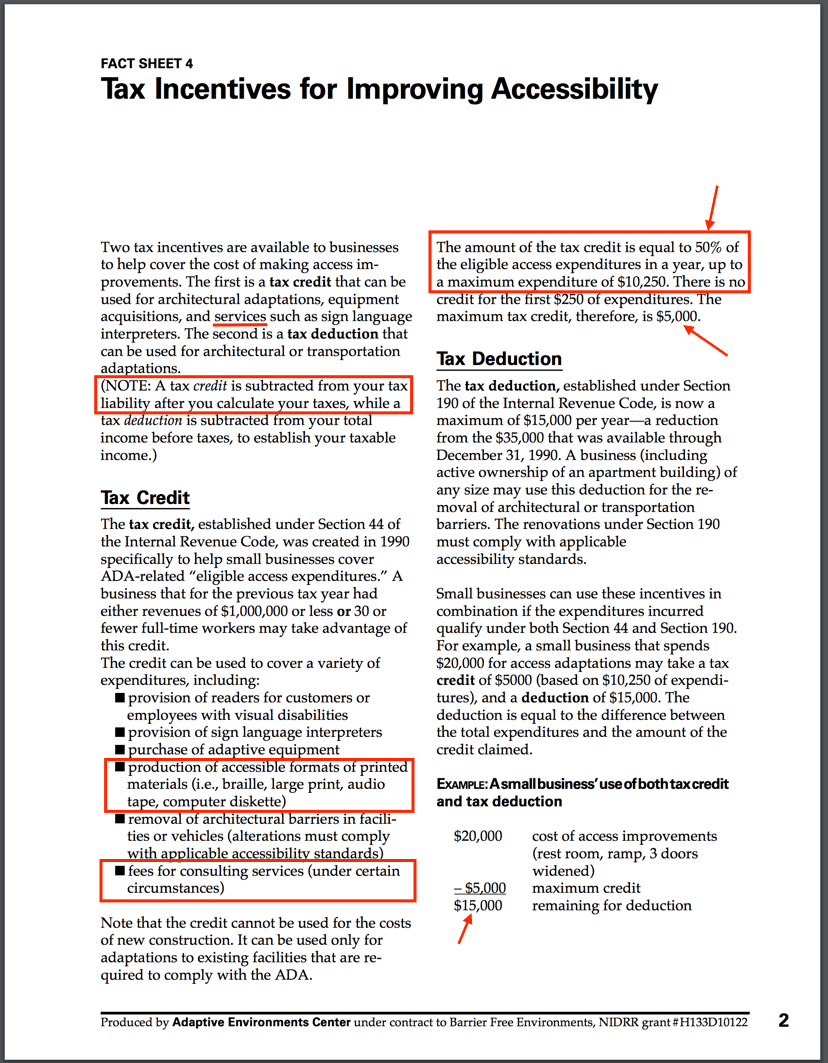

Far too many dentists are missing out on what could be considered free cash. With an updated website that is compliant with the Americans with Disabilities Act, you can claim a tax credit of up to $5000.

This credit is significant as it is up to 50% of the total cost and up to $5,000! A tax credit is basically cashback from your total tax burden. In other words, when you invest in your dental website accessibility, you will deduct the cost as a business expense. Then, you can apply for this credit when you file your taxes (no separate paperwork needed). So, you could practically get paid to update your website. Isn’t this great news?

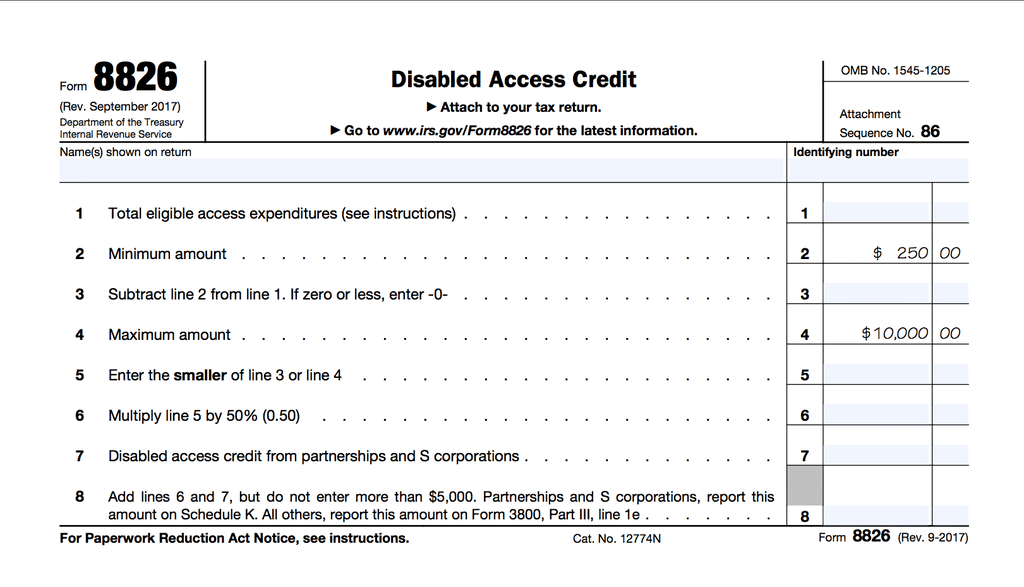

The form you or your accountant must fill out to claim the available tax credit is not even one page!

Source: https://www.irs.gov/pub/irs-pdf/f8826.pdf

It is a Win, Win, Win decision. Here is why:

1- You will be doing the right thing

Millions of people have physical limitations, hearing or vision impairments that make it impossible to utilize a regular keyboard, a mouse, or a monitor when viewing a website. Isn’t that nice to be among the few who care about that deserving group? Even if there were no tax incentives, you would have done it. It is just that sometimes we don’t think about it.

2- You Get paid for it

The US Federal Government (via the IRS) pays dentists to invest in marketing your practice when they do it correctly. The credit is $5000 or 50% of your cost. That is a lot of money. Often doctors and business people mistake Tax Credits for tax deductions. This is a tax credit. That means you calculate your taxes, deduct the cost of the website just like any other business expense, and pay your taxes. Then, when you file your taxes, you add this one-page form to the filing while deducting the $5000 from your tax bill. Boom, you just earned yourself $5000!

Obviously, being a dentist, educated and smart, you know that your accountant is the person that can tell you how this is done and what applies to you. But, from the face of it, it seems to be a very straightforward rule. Below are links to government and private sites that explain how this works.

3- Protect your practice against lawsuits

While no one can guarantee immunity from all lawsuits, not doing anything is certainly not a solution. You want to make at least it more difficult for lawyers to go after you. When you have a solution, they skip you and move on to an easier target (hopefully and most likely). See examples of websites with an Accessibility Plugin that makes it less likely to become a target.

4- Your website gets an upgrade.

The third advantage is that you get your old website updated and up-to-date, which means tons of new patients and increased production for your practice. Learn more about upgrading your website with AwDA solutions.

The source of this article is ADA.org itself. https://www.ada.gov/archive/taxpack.pdf

If this is not a no-brainer, what is? To take advantage of this credit, consider new website features from Optimized360. If you need additional documents or explanations, contact us today.

And don’t forget, your state taxes may also offer additional incentives.

You don’t have to take our word for it. This is how ‘Bard’ Google’s new AI responded to this question on April 14, 2023

Keep in mind that there seems to be an income limitation, which applies to practices with less than 30 employees and an income below $1,000,000.